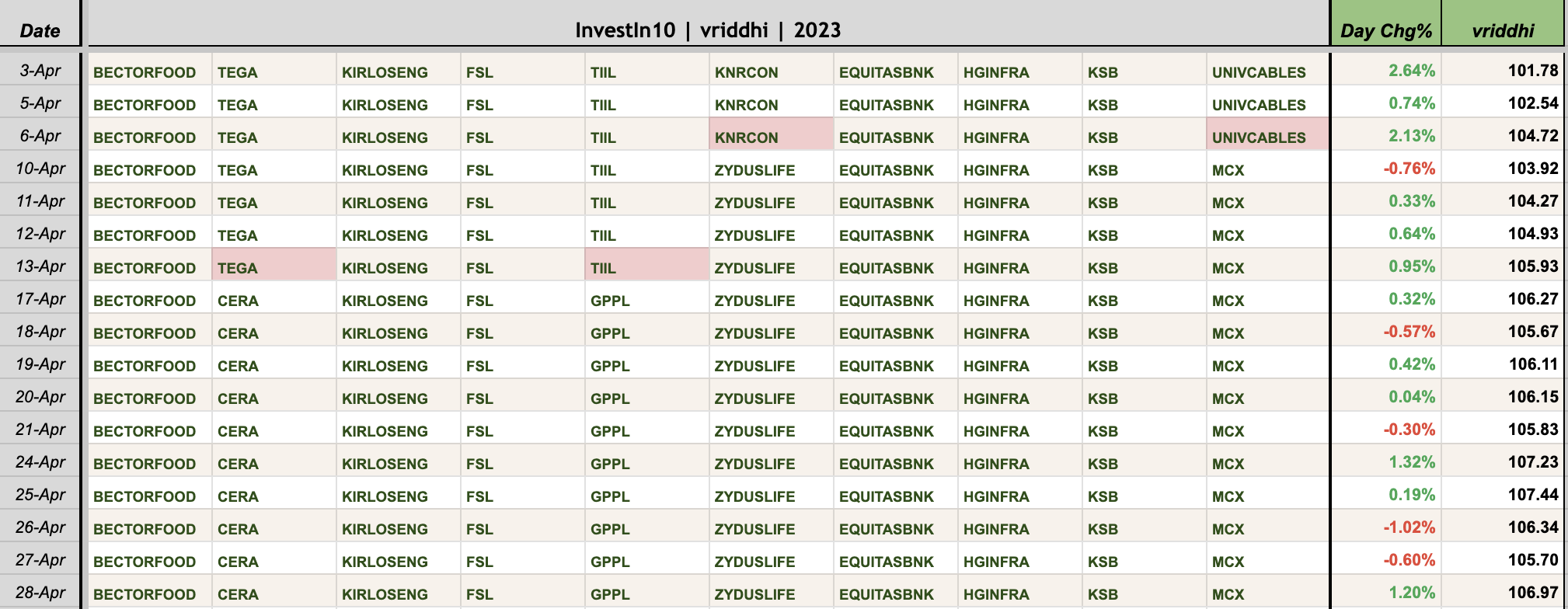

April was a good month for vriddhi strategy. The first week of April was very bullish as the Market was coming out of a 3-month correction phase, and most of the gains for the strategy came in that duration. Now, the Market appears to be consolidating and deciding the future direction.

Vriddhi Strategy outperformed Nifty by 3.8% for the month of April.

There were only 4 transactions for the month of April. InvestIn10 had Re-balanced into strong stocks by the end of March expecting this rally.

Vriddhi strategy Valuation metrics. These metrics are for reference only. InvestIn10 doesn’t use any of these metrics for stock selection.

Individual Stock analysis

There will be a Re-balance update later today, so keep plugged in. Also will try to analyse the Market Breadth and the way forward.

Leave a Reply